5 Easy Steps to Rebuild Your Credit after Bankruptcy in Michigan.

If you’ve filed for bankruptcy, you know the difficulties in re-establishing your credit. Here you’ll find five easy steps to help you rebuild your credit after bankruptcy.

Bankruptcy is one of the most harmful things you can do to your credit score. After all, it sticks around on your credit report for seven or ten years, depending on the type of bankruptcy you file.

But if you get into a sticky financial situation, sometimes bankruptcy is the right option. For instance, let’s say you have a ton of medical debt that you have no way to pay. In this case, filing for bankruptcy can help you resolve the situation sooner. Rather than continuing to make late payments as you struggle for years, you can make your debt more manageable now.

In essence, when you file for bankruptcy, you’re taking a credit score hit now so that you can ultimately save your credit score and finances in the long run.

The beauty of credit is that nothing is forever. Your credit score is meant to show potential lenders how you manage credit at any given time. Even if you’ve managed it poorly in the past, that may not always be the case. With some time and hard work, you can recover even from bankruptcy.

But where do you begin when it’s time to rebuild your credit score after bankruptcy? Here are the steps to take.

Step 1: Budget for Your Remaining Debts

Bankruptcy probably wiped out most of your debts, but maybe not all of them. And depending on the outcome of your bankruptcy, you may still have to pay several minimum debt payments. And of course you may incur additional debt after bankruptcy.

So your first step is to get into a position where you know, without a doubt, that you can make all of those payments every month.

The goal here is to never miss a minimum payment–or even make one late–ever again. This starts with having a solid budget.

During the bankruptcy filing, the courts should account for your current income and necessary expenses. So you should no longer be in over your head with debt payments. But it’s easy to get back in over your head if you aren’t careful. So make sure you take the following steps, starting today:

- Stop using debt. Your old credit card accounts are probably closed. But if you happen to have any still open, close them down now. We’ll talk in future steps about using debt responsibly. But to start, don’t use debt at all while you’re getting resettled.

- Keep track of your spending. Start using a tool like Mint or YNAB to track your spending. Be sure you stay within reasonable limits so you can always make your minimum payments on time.

- Build up an emergency fund. Having some money in savings can help you weather future emergencies without going back into debt. Start putting money into a savings account to be used only for emergencies. It’ll make following the next credit-building steps easier.

Once you’ve stuck to your budget for a few months, then start taking the following steps to actively rebuild your credit score.

Step 2: Check Your Credit Report

Sometimes during bankruptcy filings, things don’t get reported to credit reporting bureaus as they should. So now is a good time to check your credit report.

One common mistake after bankruptcy is that negotiated accounts aren’t reported properly. This means your accounts can continue to show as delinquent. This can cause your credit score to drop even more. So make sure that every account that was negotiated as part of your bankruptcy shows up properly.

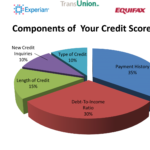

Getting your credit report is simple. You can get one report per year from each of the three credit reporting bureaus from www.annualcreditreport.com. You’ll want to pull a report from each of the three bureaus–Experian, Equifax, and Transunion. Sometimes the information that appears on one won’t appear on the others. So check all three to make sure they are accurate, we suggest www.CreditKarma.com

A word of warning. The information in your credit report won’t be updated until your bankruptcy has been completed. Once it’s complete, give the bureaus a month or two to catch up. Then you can pull your free reports to ensure everything has been updated accurately.

You can also keep track of your credit score in a myriad of ways. As you focus heavily on rebuilding your score, you might sign up for a monthly credit report service. Or check out free credit score estimate services like Quizzle and Credit Karma.

These services give you access to your numerical credit score. Plus, they offer historical score information. This can be helpful so that you can watch as your efforts increase your credit score.

What if you notice inaccuracies on your credit report? Your first step is to call the lenders who are inaccurately reporting information. Get a step-by-step guide to correcting mistakes on your credit report here.

Step 3: Get a Secured Credit Card

You might be surprised at this step. After all, didn’t we just say that step one was to stop using credit? That’s true. But it’s also true that responsible credit use is the quickest way to rebuild your credit score. So you have to start somewhere.

The key here is the word “responsible.” You should only take this step after you have your spending well in control. You’ll get this credit card, but you’ll only use it for certain expenses. And you need to be able to pay it off in full every single month.

Once you think you can handle this, apply for a secured credit card. These cards require you to put down a deposit. If you deposit $200, you’ll typically get a $200 line of credit. Then if you don’t make your payment on time, the credit card issuer will take money from your deposit to cover the payment.

The best secured credit cards report your usage to all three credit bureaus. And some will even automatically convert to an unsecured credit card after a certain amount of time. When you’re shopping for a secured credit card, be selective. Here’s what you should look for:

- Reporting to credit bureaus. This is the absolute most important quality. If the secured card company doesn’t report to all three credit bureaus, it won’t help you rebuild your credit. So it’s not worth your time.

- Allows for increased credit limit. You might start out with a very low credit limit. Look for a card that allows you to increase your credit limit with responsible use. A higher credit limit will positively impact your credit score.

- Converts to an unsecured credit card. Ultimately, you want to get your credit score to a place that you can get unsecured credit again. Some prepaid cards will start checking your credit monthly (which doesn’t harm your credit). Once you get to the right score, they’ll automatically move you over to an unsecured credit card.

- Refunds your deposit. Once you’re done using the secured credit card, you should get your remaining deposit back. This is typical, but check the fine print to ensure that it’s true of the card you choose.

- Has no annual fee. Plenty of secured credit cards these days have no annual fee. If possible, look for a card that won’t cost you anything beyond your deposit to use.

- Allows for rewards. This isn’t an essential. You’re focused on rebuilding your credit score, not getting rewards. But some of today’s secured cards do offer points and cash-back rewards. This can be a nice perk if the card also meets these other requirements.

Once you qualify for a secured credit card, start using it. But be sure you can pay it off immediately every month. The best option is to use it only for expenses that are part of your regular budget. For instance, you could use the card for gas and only gas. Then pay it off as soon as the bill comes each month.

Over time, you can add more money to your secured card’s deposit account. This will increase your credit limit. As long as you keep your balance at $0, this can be very good for your credit score. You can learn more about how your balance-to-limit ratio affects your credit score here.

Step 4: Apply for an Installment Loan

This step is included on an as-needed basis. It’s the next-to-last step because it’ll be the toughest. It will take you time to qualify for an installment loan. And you shouldn’t borrow much just to increase your credit score. But you can build your credit score by diversifying your credit portfolio and making more on-time payments each month.

If you’re in a tight spot with your credit, don’t take out an unsecured personal loan for something unnecessary. You’ll pay interest through the nose! But if you, for instance, really do need a new car and can’t afford to pay cash, this can be a good place to start. Even a low-balance car loan will likely charge high interest if you’re recently been through a bankruptcy. So be sure the payments are manageable. And consider paying off the loan early so you don’t have to pay all that interest. Even making the payments over a year or eighteen months can help boost your credit score.

Step 5: Give it Time

Ultimately, your credit score won’t be perfect again until the bankruptcy record falls off of your report after either seven or ten years from the date of filing. However, according to FICO, the older your bankruptcy is, the less impact it has on your score.

This means that even three or five years out from a filing, your score can be significantly better than it is right now. If you were a financial mess pre-bankruptcy, you might even be in a better place than you were before you filed bankruptcy.

Just be sure that you continue to take these steps–especially using credit responsibly, maintaining $0 balances, and making payments on time. As you take these steps, your financial responsibility will shine through. And, eventually, you’ll live down that bankruptcy and be on your way to an excellent credit score.

Previous Post

Previous Post Next Post

Next Post